Nvidia executives and board members are turning their AI gold rush into cold hard cash. Big time.

Company insiders have dumped more than $1 billion worth of stock over the past year. Half of that — over $500 million — happened just this month as the chip giant’s shares hit record highs.

The timing tells a story. These aren’t panic sales. They’re victory laps.

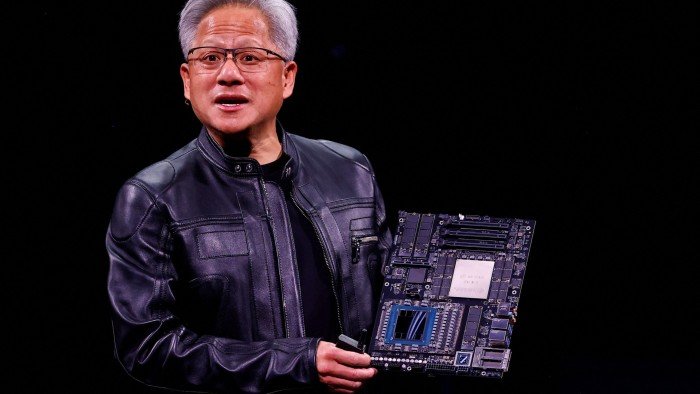

CEO Jensen Huang jumped back into selling this week. First time since September. His timing? Surgical precision. He waited through the rocky first quarter when the stock tanked, then pounced when shares climbed back above $150.

“When the stock [dropped] in the first quarter, he did not sell, [which was] was really smart,” said Ben Silverman, vice-president of research at VerityData. “[Huang] waited for the stock to return to levels that he felt more comfortable selling at.”

Smart doesn’t begin to cover it. Huang’s sales follow a pre-arranged trading plan set up in March. These plans let executives avoid insider trading accusations by locking in sale dates and prices ahead of time. He can sell up to 6 million shares before year-end. At current prices, that’s potentially $900 million in his pocket.

Not that Huang needs the money. Forbes pegs his net worth at $138 billion.

The selling spree extends far beyond the CEO. Nvidia’s old guard is cashing out as the company they helped build becomes the world’s most valuable corporation.

Mark Stevens, a longtime board member and former Sequoia Capital partner, announced plans to sell up to 4 million shares worth $550 million. He’s already moved $288 million. Stevens was one of Nvidia’s earliest investors, back when the company was just another Silicon Valley startup.

Executive vice-president Jay Puri, who’s been with Nvidia for two decades and often stands in for Huang on China trips, sold $25 million worth Wednesday. Board members Tench Coxe and Brooke Seawell joined the parade. Coxe unloaded $143 million in June. Seawell sold $48 million this month.

These aren’t newcomers looking for quick wins. Coxe, a former Sutter Hill Ventures managing director, has been on Nvidia’s board since the early days. Seawell joined in 1997 when AI was still science fiction. She’s a partner at venture firm New Enterprise Associates and former Synopsys executive.

The company they’re selling was born in 1993 in a Denny’s restaurant in San Jose. Huang co-founded it as a video game graphics card company. Nobody then imagined those gaming chips would become the engines powering the AI revolution.

Nvidia’s market value has exploded to $3.8 trillion. That’s a quadrupling in just a few years as companies and governments throw billions at AI infrastructure. The recent surge follows a brutal stretch where trade tensions and Chinese AI breakthroughs hammered the stock.

DeepSeek’s surprise AI advances spooked investors earlier this year. New US export controls on China-bound AI chips added more pressure. Nvidia’s market cap shed massive value before bouncing back. The company has now regained about $1.5 trillion since April’s low point.

The insider sales raise obvious questions. Are these executives signaling peak euphoria? Or just taking profits while the getting’s good?

The pre-arranged trading plans suggest the latter. These sales were mapped out months ago when the stock was lower. The 90-day cooling-off period for Huang’s plan just expired, triggering his recent transactions.

Still, the scale is staggering. Over $1 billion in insider sales tells a story about confidence and cashing out. These executives built Nvidia into an AI powerhouse. Now they’re converting their paper wealth into something more tangible.

Whether that’s smart portfolio management or a warning sign depends on your view of AI’s future. Either way, Nvidia’s insiders aren’t waiting around to find out.