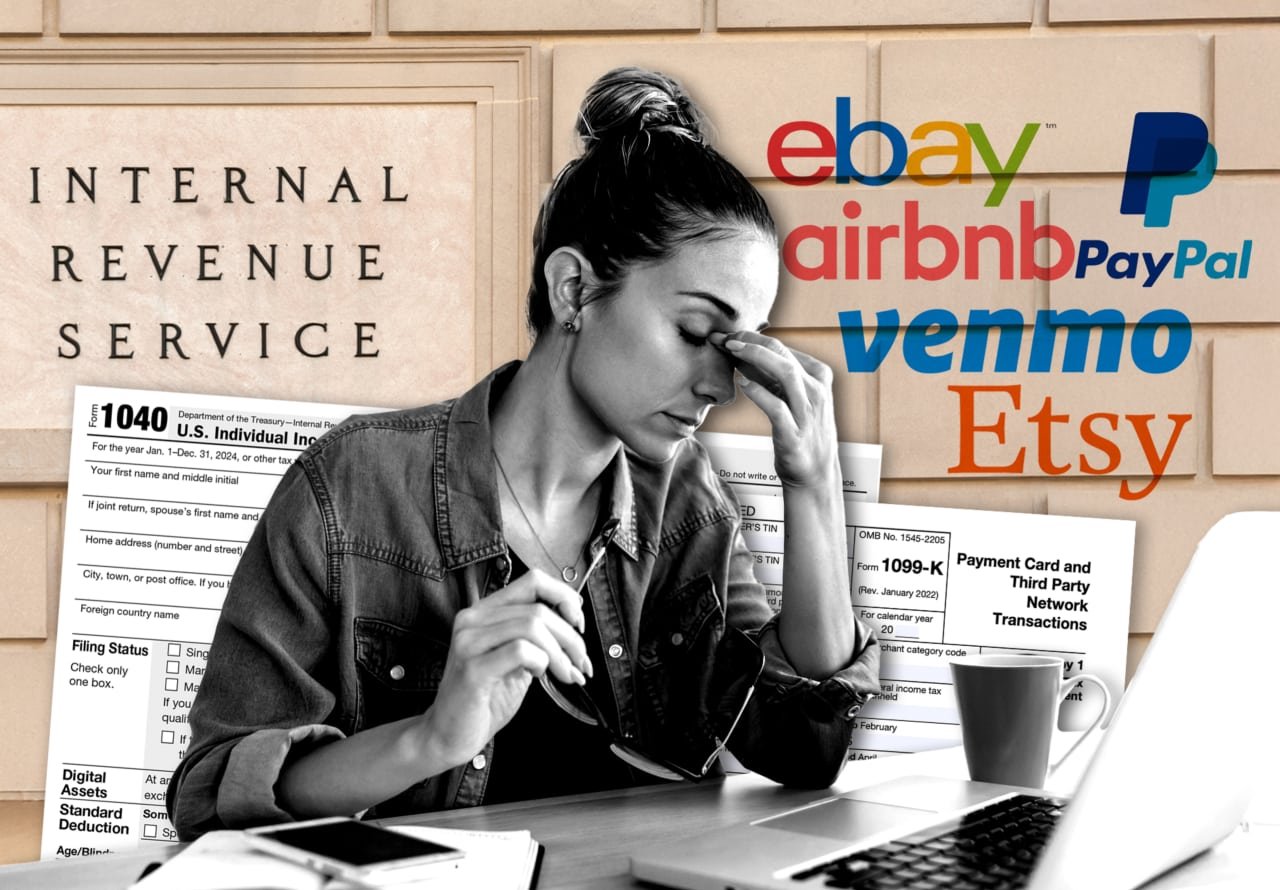

House Republicans took aim at gig workers and online sellers last month. Their megabill includes a sneaky provision that kills the $600 reporting threshold for 1099-K tax forms.

Here’s what that means. Right now, payment processors like PayPal and Venmo are supposed to send tax forms to anyone who makes more than $600 a year. The IRS gets copies too.

Republicans want that gone.

The provision quietly tucked into their sweeping legislation would end this reporting requirement entirely. No more 1099-K forms for small-time sellers. No more paper trail for the taxman.

This isn’t just about eBay sellers hawking old clothes. Uber drivers, freelance writers, and anyone getting paid through digital platforms could fly under the radar again.

The $600 threshold was already controversial. It replaced the old $20,000 limit that let most casual sellers avoid paperwork. Democrats pushed the change through as part of their revenue-raising efforts.

But implementation has been messy. The IRS delayed enforcement twice. Too many people were getting forms for transactions that weren’t actually taxable income. Birthday money from grandma. Rent splits with roommates. Innocent stuff.

Republicans pounced on the confusion. They’re painting this as government overreach. Big Brother watching your Venmo account.

The reality is more nuanced. The 1099-K doesn’t create new taxes. It just creates a paper trail. You still owe taxes on business income whether you get the form or not.

Still, the political optics are terrible for Democrats. Nobody likes surprise tax paperwork.

The House bill probably won’t survive the Senate unchanged. Democrats control that chamber and the White House. But this provision shows where Republicans want to go.

They’re betting Americans hate tax compliance more than they care about revenue collection. Given the backlash to the 1099-K rollout, they might be right.

For now, the $600 threshold remains law. But its future looks shaky.

Gig workers and online sellers should keep careful records either way. The IRS expects its cut regardless of what forms show up in your mailbox.