Robinhood denies options trading access for several key reasons. Insufficient trading experience tops the list. Low account balances or inadequate net worth create financial barriers. Incomplete applications with missing employment or income details trigger automatic rejections. Risk tolerance misalignment affects approval chances. Some traders hit regulatory restrictions, particularly those averaging 390+ option orders daily under CBOE Rule 390. Application errors and inconsistent financial information raise red flags. Understanding these approval requirements reveals specific steps to improve eligibility chances.

Common Reasons for Options Trading Denial

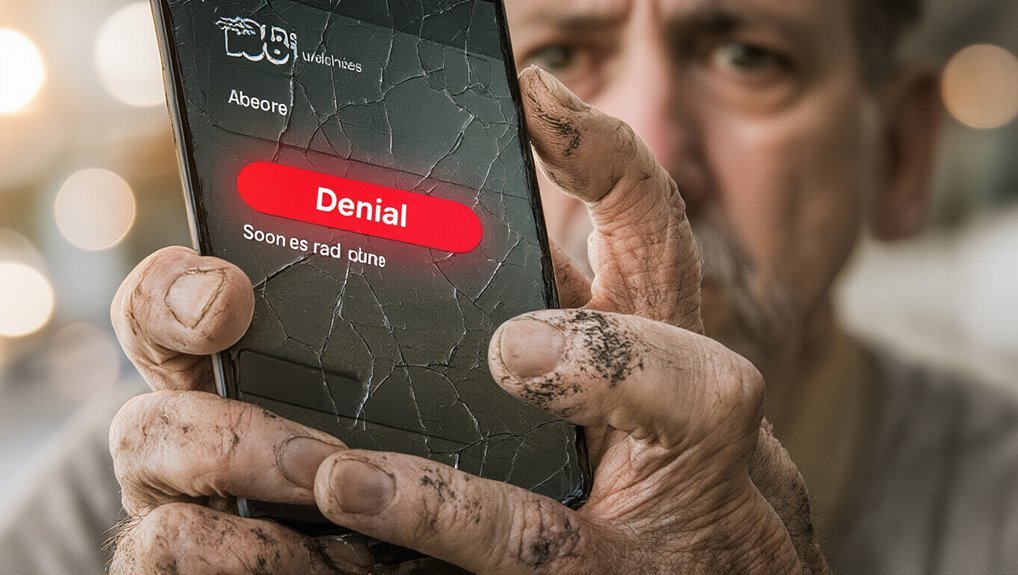

While many traders assume they’ll automatically qualify for options trading on Robinhood, the reality is far more complex. The platform rejects applicants for several key reasons.

Insufficient trading experience tops the list. Novice investors often lack understanding of options strategies, signaling risk tolerance mismatches. Most get approved only for Level 2 basic strategies. Advanced spreads? Forget it.

Financial constraints create another hurdle. Low account balances or inadequate net worth frequently disqualify applicants. Income levels matter too. Robinhood assesses whether traders can absorb potential losses before granting Level 3 access.

Risk tolerance misalignment causes denials. Conservative profiles rarely qualify for complex strategies involving options. Aggressive growth goals fare better—if experience and capital align. Options trading requires approval on Robinhood as it may not suit all investors due to the higher risks involved.

Application errors derail approvals. Incomplete questionnaires, inaccurate income reporting, or inconsistent answers trigger rejections. Outdated profiles need updates. Fortunately, users can update their financial profiles and reapply if initially rejected.

Regulatory restrictions add complexity. Professional traders face CBOE 390 Rule limitations. Pattern day trading violations block access. Many stocks also lack options availability due to regulatory standards or insufficient market activity. Compliance issues override personal qualifications.

Robinhood’s Approval Level Requirements

Though applicants often view options approval as binary, Robinhood operates a sophisticated tiered system that determines precisely which strategies traders can access. The approval levels create distinct boundaries between trading capabilities.

Level 2 serves as the entry point. Most new traders start here. It grants access to basic strategies: long calls, long puts, and covered positions. Simple. Straightforward.

Level 3 reveals complexity. Credit spreads, debit spreads, iron condors, and iron butterflies become available. These strategies require greater experience and higher account balances.

The progression isn’t automatic. Robinhood evaluates multiple factors before upgrading traders to advanced levels. Remember that each standard option controls 100 shares of the underlying stock, which affects position sizing and risk calculations at every approval level. Options trading involves significant risk and may result in total investment loss, making proper approval levels essential for trader protection.

| Approval Level | Available Strategies | Key Requirements |

|---|---|---|

| Level 2 | Long calls/puts, covered calls/puts | Basic experience, moderate balance |

| Level 3 | All Level 2 + spreads, iron strategies | Extensive experience, higher balance |

| Denied | No options access | Insufficient experience/balance |

| Upgrade Path | Reapply with updated information | Demonstrate increased capability |

Understanding these distinctions helps traders set realistic expectations and plan their application strategy accordingly.

Application Mistakes That Lead to Rejection

Since Robinhood’s options approval process relies heavily on automated screening systems, even minor application errors can trigger instant rejections. Missing employment status or income details causes automatic denial. Inconsistent information raises red flags. Contradictory answers about financial standing create problems.

Insufficient account funding below minimum requirements kills applications immediately. Unverifiable bank statements hinder approval. Recently funded accounts without stability history face rejection.

Trading experience documentation proves essential. Beginner-level experience conflicts with options risk profiles. Missing prior trading statements reduces credibility. No documented losses or risk management practices prevents proper evaluation.

Risk assessment mismatches doom applications. Conservative risk tolerance incompatible with options trading triggers denial. Investment goals misaligned with speculative nature cause problems.

Technical issues create additional hurdles. Incomplete submissions get auto-rejected. Browser timeouts lose application data. Illegible document uploads prevent verification. Outdated app versions fail to transmit properly. System outages during submission result in lost applications requiring restart. Different broker capabilities regarding advanced trading features may also affect options eligibility decisions. The review process typically requires around 24 hours for completion once all documentation is properly submitted. Applicants must meet Level 2 or 3 options trading approval requirements before accessing advanced features like event contracts.

Regulatory Restrictions and Professional Trader Classifications

Beyond application errors, regulatory frameworks create additional barriers that can permanently restrict options trading access on Robinhood. The most significant hurdle involves professional trader classifications under CBOE Rule 390.

Regulatory frameworks impose permanent barriers to options trading access, with professional trader classifications creating the most significant obstacles.

This rule targets high-volume traders. Anyone averaging 390 option orders per trading day in a calendar month gets flagged as professional. The consequences are severe. These traders face a three-month lockdown where they can only close existing positions. No new options trades allowed.

Robinhood enforces this restriction automatically. The platform monitors trading activity and applies limitations when thresholds are crossed. Professional status also considers employment at financial institutions or access to market-making information.

Misclassification creates problems too. Traders must honestly disclose their status during applications. False information leads to account restrictions or outright denials.

The tiered approval system complicates matters further. Level 2 grants basic strategies. Level 3 opens up complex trades like spreads. Each level requires meeting specific regulatory criteria.

Frequently Asked Questions

How Long Does Robinhood Take to Review My Options Trading Application?

Robinhood doesn’t publish exact review timelines for options applications. User reports indicate reviews range from several hours to multiple business days. The duration depends on application volume and individual account details. Level 3 approval requests typically take longer due to stricter eligibility requirements. Incomplete applications or professional trader classifications can extend the process. Review time varies considerably based on these factors.

Can I Appeal Robinhood’s Decision if My Options Application Gets Denied?

Robinhood doesn’t offer a formal appeal process for denied options applications. Traders can’t contest decisions through customer service or compliance channels. The only recourse is reapplying. Applicants must update their financial profiles, gain more trading experience, and resubmit the questionnaire with accurate information. Success depends on meeting eligibility criteria for experience, account balance, and risk tolerance. Improvement and resubmission remains the sole pathway to reconsideration.

What Happens to My Existing Options Positions if I Lose Approval?

Existing options positions remain active and tradeable when approval is revoked. Users can close positions by selling or exercising contracts. Opening new positions becomes impossible until re-approval. Standard expiration and assignment rules continue operating normally. Margin requirements must still be met to avoid forced liquidation. Rolling or modifying positions may face restrictions. The platform typically provides notification when approval changes occur, allowing users to adjust their portfolio management strategy accordingly.

Does Having a Margin Account Affect My Options Trading Eligibility Status?

Having a margin account markedly affects options trading eligibility on Robinhood. Advanced strategies require margin accounts since they involve leveraging positions. Cash accounts restrict access to complex options like uncovered calls. Margin status alone doesn’t guarantee approval—Robinhood evaluates experience, income, and risk tolerance too. Higher options levels typically demand both margin accounts and sufficient balances. Users need complete margin setup in good standing to maximize eligibility chances.

Can I Transfer Options Positions From Another Broker to Robinhood?

No, Robinhood doesn’t accept direct transfers of open options positions from other brokers. The ACATS system only handles stocks, ETFs, and cash—not active derivatives contracts. Options must be closed or exercised at the original broker before transferring. After moving the account, users need separate approval for Robinhood options trading through their questionnaire process, regardless of previous options experience elsewhere.

Conclusion

Options trading denial on Robinhood typically stems from four key factors. Income and experience misrepresentation during application. Insufficient net worth or liquid assets. Failure to meet specific approval level requirements. Regulatory classifications that restrict certain traders. Most rejections trace back to application errors or overstating qualifications. Users can reapply after thirty days with corrected information. Success depends on honest self-assessment and understanding platform requirements before submitting applications.